virginia ev tax credit 2020

How Much Is the EV Tax Credit. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page.

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Charging Incentives Support Growing Virginia EV Adoption May 27 2021.

. Virginia EV tax credit for 2022. Virginia is for loversand electric-car advocated had hoped that it would soon be for lovers of electric cars and plug-in hybrids too. Points of Contact Get contact information for Clean Cities coalitions or agencies that can help you with clean transportation laws incentives and funding opportunities in Virginia.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. File With Confidence When You File With TurboTax. However you should be aware of the following requirements.

Beginning September 1 2021 a resident of the Commonwealth who is the purchaser of a new or used electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500 subject to the availability of funds in the Fund. The amount of the tax credit ranges from 2500 to 7500 depending on the size of your battery. For a qualified vehicle with a fuel cell battery 3000 for.

Local and Utility Incentives. 4500 EV Tax Credit. Some hybrid electric vehicles have smaller batteries and dont quality for the maximum tax credit amount.

The working group published a report with program recommendations to the Virginia General Assembly on November 1 2020. The EV rebate program must be operational by December 30 2021. Lets say you owed the federal government 10000 in taxes when filing your 2021.

Richmond EV Readiness Plan May 3 2021. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an. Based on your EVs battery capacity and gross weight your credit can range from 2500 to 7500 provided it also has at least five kilowatt-hours of capacity and uses an external charging source.

From such funds as may be appropriated the Commissioner shall issue a rebate pursuant to the provisions of this section as follows. Resources for Multi-Unit Dwelling Charging April 28 2021. To claim the Economic Opportunity Tax Credit against the West Virginia personal income.

Anyone know anymore details on this. Eligibility for rebate. Review the credits below to see what you may be able to deduct from the tax you owe.

Virginias Initial Electric Vehicle Plan May 4 2021. Electric Vehicles Solar and Energy Storage. While Virginias General Assembly has committed to adopt stricter transportation emissions standards by 2025 that will encourage more widespread use of electric vehicles lawmakers final budget includes no funding for a rebate program intended to bring down the vehicles cost for consumers.

Reference House Bill 717 2020 Natural Gas Vehicle NGV Technician Certification. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

If your EV was made in the US with a union workforce. Virginia entices locals to go green by offering numerous time- and money-saving green driver incentivesThese perks include alternative fuel vehicle AFV emissions test exemptions for electric cars and hybrids high occupancy vehicle HOV lane access for clean-fuel vehicles state and federal tax incentives discounted electric vehicle EV charging rates fuel-efficient auto. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up-front costs of these vehicles.

The EV tax credit is currently a nonrefundable credit so the government does not cut you a check for the balance. 500 EV Tax Credit. This thread is archived.

Virginia EV tax credit for 2022. Industrial Expansion and Revitalization Tax Credit for Electric Power Producers 8. Clean Cities Coalitions Virginia is home to the following Clean Cities.

Expired Repealed and Archived Laws and Incentives View a list of expired repealed and archived laws and incentives in Virginia. Am starting to look at EVs and it would be nice if that 3500 was there. Simplify Your Taxes And Your Life.

Whats the chances Virginia will pass that EV tax credit bill in 2020. I havent seen anything really on it but it looks promising. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Dealerships havent mentioned it either. We were hoping to get money in there now said Del.

Up from 65627 in 2020 to have. Some other notable changes include. And I cant find any website that it says should be created.

To begin the federal government is offering several tax incentives for drivers of EVs. Whats the chances Virginia will pass that EV tax credit bill in 2020. A bill proposed in mid-January by Virginia House Delegate.

The EV rebate program would expire on July 1 2027. Beginning September 1 2021 a qualified resident of the Commonwealth who is. Get Your Max Refund Today.

Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. EV Charging Equipment Federal Tax Credit up to 1000 Consumers who purchase qualified residential charging equipment prior to December 31 2021 may receive a tax credit of 30 of the cost up to 1000.

EV vans trucks and SUVs with an MSRP of up to 80000 qualify increase from before. Here are the currently available eligible vehicles. If at least 50 of the battery components in your EV are made in the US.

Check out these National Drive Electric Week Events in Virginia. Depending on the vehicle you plan to purchase or currently own there are several federal tax credits that may apply to your situation.

Rebates And Tax Credits For Electric Vehicle Charging Stations

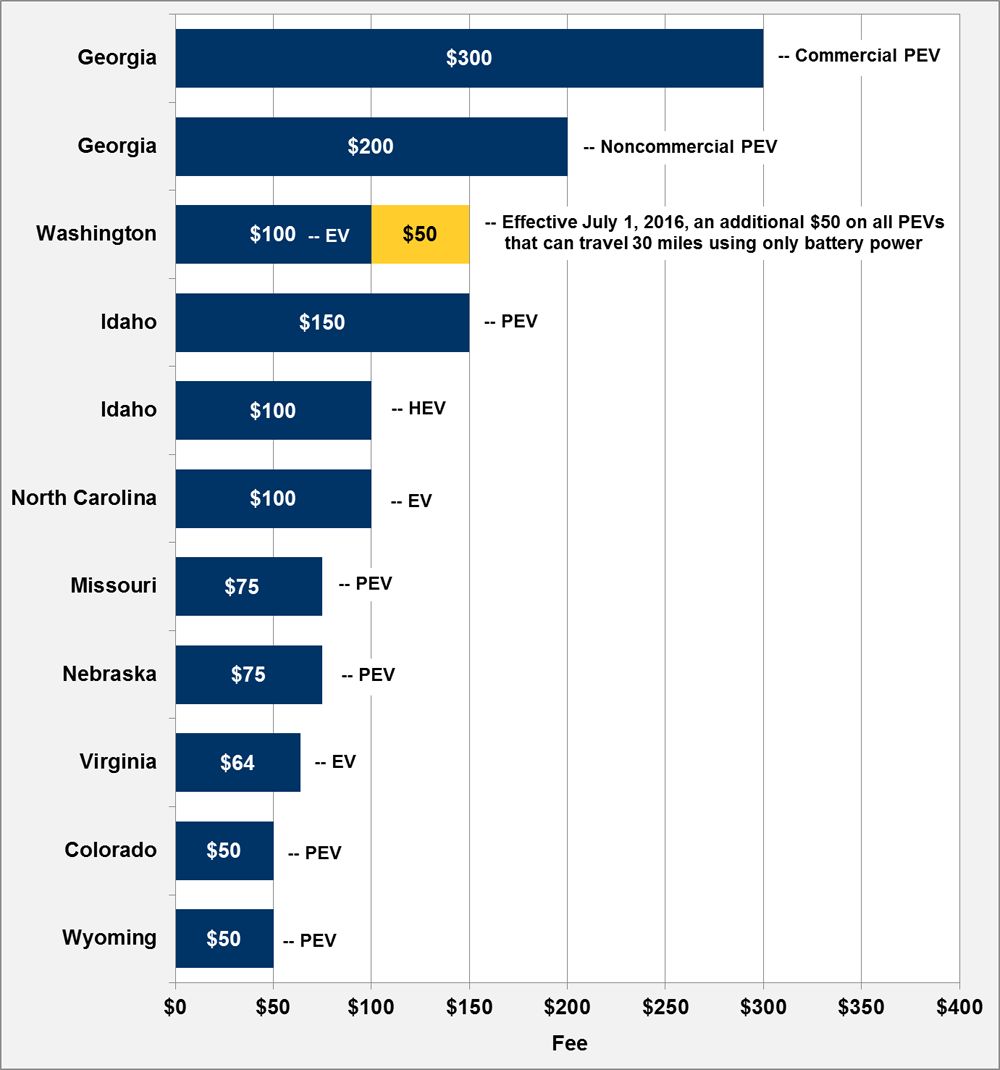

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

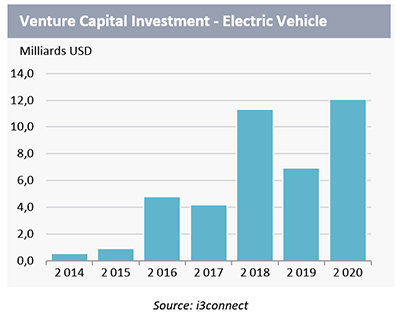

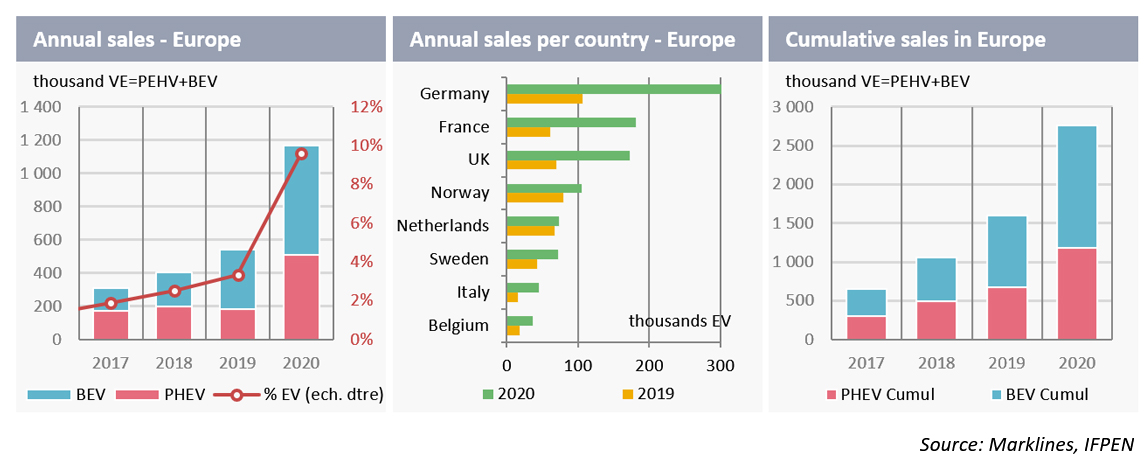

A Global Car Market On A Roller Coaster Ifpen

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Latest On Tesla Ev Tax Credit January 2022

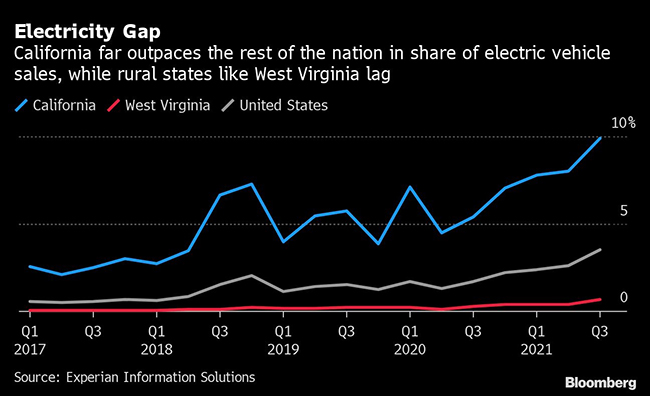

Biden S Ev Plan Faces Jam From Cultural Divide Transport Topics

Inside Clean Energy Electric Vehicles Are Having A Banner Year Here Are The Numbers Inside Climate News