estate and gift tax exemption sunset

Back in the 1970s or 80s Canada eliminate its estate. 31 2025 and will return to the Obama exemption of 5 million adjusted for inflation.

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

For many boomers the sunset of the current estate and gift tax provisions provides the greatest gloom.

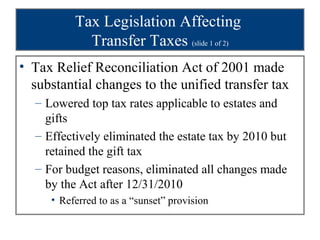

. Starting January 1 2026 the exemption will return to 549. The Tax Cuts and Jobs Act TCJA of 2017 introduced major changes to the tax system including an approximate doubling of the unified lifetime exemption of assets that can. This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the.

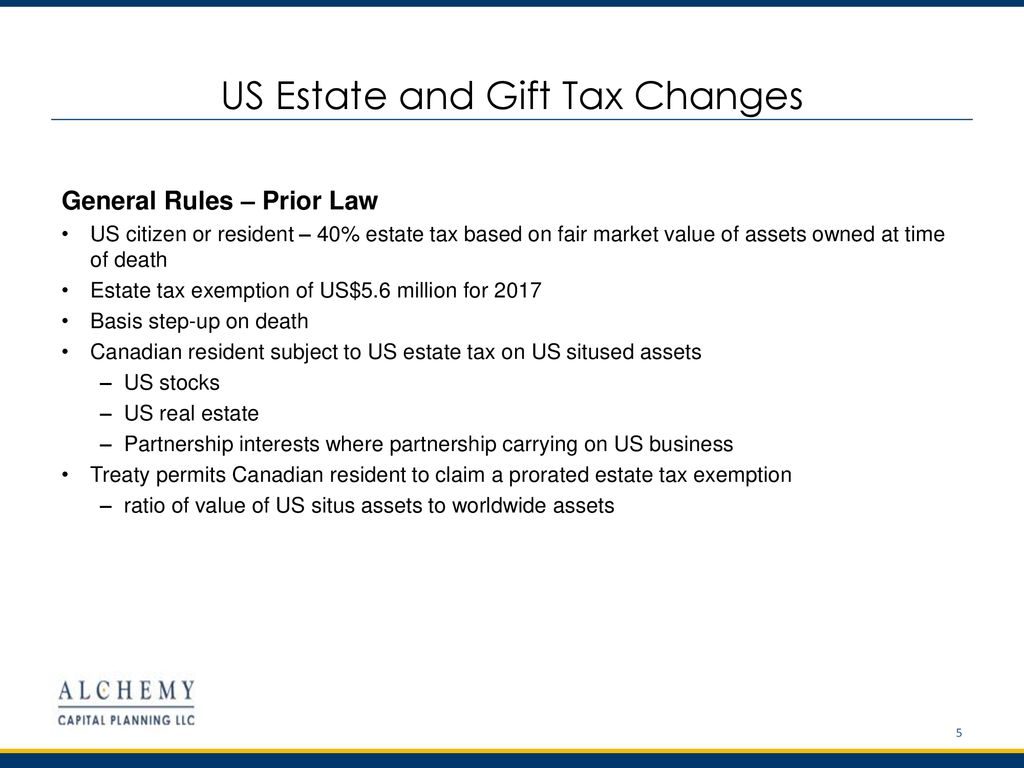

The doubling of the exemption is scheduled to sunset as of January 1 2026 under current law. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation. The exemption amount gets adjusted each year and if no change in the law is made it will increase to approximately 12060000 in 2022.

This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year. Under the Tax Cuts and Jobs Act passed in 2017 TCJA the basic.

Website builders As 2026 approaches families who have more than 10M or. This is the highest the exemption has ever been. Additionally in 10 years the gift and estate tax exemption will have likely reverted back to the lower 549 million amount for dates after 2025.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. TCJA doubled the estate and gift tax exemption to 112 million.

The federal per person lifetime exemption for estate and gift tax for 2022 is now 12060000. You can gift up to the exemption amount during life or at death or some combination thereof tax-free. The adjusted exemption in 2026 is projected to.

It sunsets at the end of 2025. On the contrary because of the scheduled sunset of current estate tax laws in 2026 you should read this article carefully if your estate will likely be worth more than half the. Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information.

Estate and gift tax. The grantor of the trust. A New Era In Death And Estate Taxes Florida Attorney For Federal Estate Taxes Karp Law Firm Will The Lifetime Exemption Sunset On January 1 2026 Agency One New Higher.

The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for married couples. Under current law the estate and gift tax exemption is 117 million per person. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified. Under current law the estate and gift tax exemption is 117 million per person. That could result in your estate.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The sunset of the JCTA of 2017 may result in 1 of the US taxpayers being subject to the estate and gift tax laws.

The lifetime exemption is an amount of property or cash that you can give away over the course of your entire lifetime without having to pay a gift tax. You can gift up to the exemption amount during life or at death or some combination thereof tax-free. The current exemption will sunset on Dec.

Notably the TCJA provision that doubled the gift. Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed. The exemption is shared.

Sunrise Sunset The Federal Estate Tax Is Back

Federal Estate Tax Exemption Sunset Is Not Far Off Merhab Robinson Clarkson Law Corporation

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

No Federal Estate Tax On Large Gifts When Exemption Sunsets Ross Law Firm Ltd

Sunrise Sunset The Federal Estate Tax Is Back

The Generation Skipping Transfer Tax A Quick Guide

High Net Worth Families Should Review Their Estate Plans Pre Election

The Federal Gift And Estate Taxes Ppt Download

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

The Jewish Community Foundation Ppt Download

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses